Running a small business with fewer than 10 employees presents unique challenges, particularly when it comes to payroll management. While larger organisations can afford dedicated payroll departments or expensive software systems, smaller firms must find the right balance between compliance, cost-effectiveness and efficiency. This guide explores practical payroll solutions tailored specifically for micro-businesses operating in the UK.

The Payroll Challenge for Micro-Businesses

Small business owners often wear multiple hats – from sales and marketing to operations and finance. Adding payroll management to this mix can be daunting, especially when considering:

- Limited resources and time constraints

- Strict HMRC compliance requirements

- The need for accuracy to maintain employee trust

- Keeping costs manageable while ensuring quality

According to recent surveys, small business owners spend approximately 5 hours per month managing payroll tasks—time that could be better invested in growing their business. Finding the right payroll solution can reclaim this valuable time while ensuring employees are paid correctly and on time.

Assessing Your Payroll Needs

Before exploring specific solutions, it’s important to understand your business’s unique payroll requirements:

Key Considerations for Small Business Payroll

- Employee count and payment frequency: Weekly, fortnightly or monthly payments?

- Pay structure complexity: Do you have hourly workers, salaried staff, or both?

- Benefits administration: Pension scheme management, statutory payments, etc.

- Growth projections: Will your team expand in the next 1-2 years?

- Technical capability: What’s your comfort level with managing digital systems?

Answering these questions will help narrow down which payroll solution best aligns with your business model and operating style.

Top Cost-Effective Payroll Solutions

1. HMRC Basic PAYE Tools

Best for: Very small businesses with straightforward payroll needs and limited budget

HMRC’s free Basic PAYE Tools offers a no-cost option for small employers. While basic in functionality, it handles essential payroll tasks including:

- Calculating tax and National Insurance contributions

- Generating payslips and reports

- Submitting RTI (Real Time Information) to HMRC

The main advantage is the price—completely free—making it ideal for startups and micro-businesses with simple payroll requirements. However, it lacks more advanced features like automatic enrolment for pensions or comprehensive reporting capabilities.

2. Cloud-Based Payroll Software

Best for: Growing businesses seeking scalability and automation

Cloud-based payroll solutions offer an excellent middle ground between basic tools and full outsourcing. Popular options like Xero Payroll, QuickBooks Payroll, and Sage Business Cloud Payroll provide:

- User-friendly interfaces designed for non-accountants

- Automated tax calculations and HMRC submissions

- Digital payslips accessible to employees

- Statutory pay calculations (sick pay, maternity/paternity)

- Integration with accounting software

Most cloud providers offer tiered pricing based on employee numbers, with plans for fewer than 10 employees typically ranging from £5-15 per month. This represents excellent value when considering the time saved and reduced risk of errors.

Tip: Many providers offer free trials, allowing you to test different systems before committing.

3. Payroll Software with Accountant Support

Best for: Businesses wanting expert oversight combined with in-house control

Some accountancy practices offer hybrid solutions where:

- You manage day-to-day payroll operations using accountant-supervised software

- The accountant provides oversight, expertise, and compliance checks

- Year-end tasks and complex calculations are handled by professionals

This approach typically costs more than self-managed software but less than full outsourcing. It provides peace of mind while maintaining some in-house control over payroll processes.

4. Full-Service Payroll Outsourcing

Best for: Business owners who want to completely delegate payroll responsibilities

For ultimate hands-off convenience, fully outsourcing your payroll to a specialised provider or accountancy firm offers:

- End-to-end management from calculations to HMRC submissions

- Expert handling of complex situations (tax queries, statutory payments)

- Regular compliance updates and implementation

- Reduction in potential errors and penalties

While typically the most expensive option (£15-30 per employee per month), the time savings and reduction in compliance risk can make outsourcing cost-effective even for smaller businesses, especially those with complex pay structures or limited in-house expertise.

Making Payroll Even More Cost-Effective

Regardless of which solution you choose, these strategies can help maximise value and efficiency:

Streamline Your Payroll Process

- Standardise pay periods: Consider moving all employees to the same payment schedule

- Implement clear policies: Develop straightforward procedures for overtime, expenses and leave

- Use electronic payslips: Save time and reduce paper waste

- Establish a payroll calendar: Create a schedule for the entire year to avoid last-minute rushing

Leverage Available Technology

- Mobile apps: Many payroll systems offer companion apps for quick approvals and viewing

- Time-tracking integration: Connect attendance systems directly to payroll

- Employee self-service portals: Allow staff to update personal details and access payslips independently

Stay Informed About Tax Relief Opportunities

Small businesses can benefit from various tax incentives and allowances that reduce payroll costs:

- Employment Allowance: Eligible employers can reduce their National Insurance bill by up to £5,000 per tax year

- Tax-free employee benefits: Some benefits like pension contributions can be more cost-effective than salary increases

- Salary sacrifice arrangements: These can benefit both employers and employees when properly implemented

Avoiding Common Payroll Pitfalls

Even with the right system in place, small businesses should be vigilant about:

- Missing HMRC deadlines: Set reminders for filing and payment dates

- Classification errors: Ensure correct categorisation of employees vs. contractors

- Outdated tax codes: Regularly check for updates from HMRC

- Overlooking pension obligations: Auto-enrolment applies to most UK employers

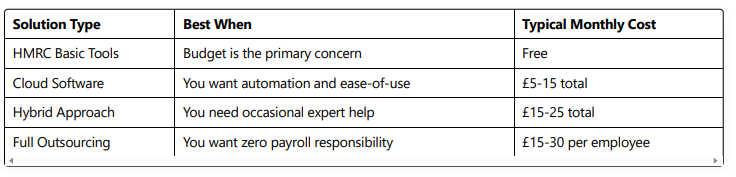

Selecting the Right Solution for Your Business

The ideal payroll solution for your business depends on several factors:

Conclusion: Balancing Cost and Convenience

For businesses with fewer than 10 employees, finding the right payroll solution means balancing immediate costs against the long-term benefits of time savings, accuracy and compliance.

The most cost-effective option isn’t necessarily the cheapest upfront. Consider the value of your time as a business owner and the potential cost of errors or compliance issues before making a decision.

Many small businesses find that cloud-based payroll software offers the sweet spot—affordable monthly costs combined with automation features that dramatically reduce time spent on payroll tasks. As your business grows, you can always transition to more comprehensive solutions.

Remember that proper payroll management extends beyond just processing payments; it’s about maintaining employee satisfaction, ensuring compliance, and creating sustainable business operations that support your company’s growth.

Need help finding the perfect payroll solution for your small business? Contact our team for personalised advice tailored to your specific requirements.